NAV lending (net asset value) is a useful tool that has been growing rapidly in usage since 2021. It is primarily used by private equity firms and entails taking a loan at the fund level, collateralized by a percentage of the fund's total portfolio equity. Goodwin Law and Penn Law Review both assert that the market will reach approximately $650 billion USD outstanding by 2030, up from today's estimation of $50 billion USD. It's difficult to attribute a precise market size value to NAV lending due to its private nature.

PE firms have taken a divided stance against these loans for two primary reasons. The first is that the liability appears on the fund's balance sheet. They also believe that (this will be clearer once NAV loan use cases are covered) if the portfolio company requires a NAV loan, then it isn't a strong asset. They are not wrong; NAV loans aren't a general liquidity tool. However, when used for time-optionality instead of value creation, NAV loans expand a PE firm's horizons.

I will show how most PE OpCos face earnings downturns, often leading to liquidity crises, which can force early exits, and how NAV loans can give the fund optionality in these scenarios. I will also show how using NAV loans to recycle capital ahead of exit can lead to greater returns.

Liquidity Trough Optionality

Private equity is inherently a risky business. Just as small caps experience volatile returns due to cyclical sensitivity, OpCos live in the same universe. Empirical data shows many disturbing facts about PE-backed companies that support this statement.

Let's take the perspective of a PE fund manager. Say an OpCo is experiencing a crisis due to external factors. It's in the early stages of its holding period and operating with little to no covenant headroom. It cannot add more leverage due to negative covenants; its cash pile is depleting. What do you do? There are really three options:

- Inject cash. This option ties up cash without offering a tax shield. Concentrates cash into a singular point of failure (a risky one at that).

- Sell a portion of the company's equity. Realize a loss by selling in distress? Again, not a strong option.

- Take a NAV loan for a short-term liquidity bridge. Leaves cash for other opportunities. Can be structured according to fund strategy, conservative with amortization, or more liberal with bullet payment and PIK.

Using the NAV loan allows for the fund to retain optionality; they can wait and choose to exit if things remain grim, or they can weather the storm to exit in clearer waters. That being said, there are some limitations:

- There is no tax shield as the loan sits at the fund level and PE runs on capital gains.

- The interest on the loan eats into returns.

- And lender stipulations can cause friction across other opportunities.

Note: NAV loans mustn't be used when the business model is fundamentally flawed. I am only promoting their usage when a strong business is facing short-term headwinds, causing a liquidity crisis. If the company is not sustainable, do not use leverage to hide poor performance.

By preserving optionality during liquidity troughs, NAV loans allow GPs to avoid crystallizing temporary underperformance. This creates the conditions for capital recycling rather than capital loss.

Capital Recycling

The global market is growing increasingly saturated in PE funds YoY. With each new fund comes increased competition for PE deals and fewer opportunities that meet risk-adjusted return metrics. With this consideration, entering into a new deal comes at a higher opportunity cost as multiple expansion is less reliable in this expensive market. Being prepared to pounce when a unicorn appears is key for fund performance, and NAV loans can be an effective tool to step into these opportunities quickly.

Let's consider this scenario: a fund has 5 portfolio companies; exits are planned 4-6 years out on all except for 1. This outlier has a planned exit in 1-1.5 years. The fund has come across a time-sensitive opportunity in which they have high conviction to earn outsized returns. They can either:

- Raise more capital

- Issue a NAV loan against their portfolio to act as the equity portion in the deal, which will be paid back at the exit of the outlier company.

NAV loans have historically been made at low LTVs (<15%); the drag on returns is near-negligible.

ΔMOIC = LTV × (Repayment multiple - 1)

Assume it's a 10% LTV loan with a liberal 1.4x repayment multiple.

*Remember, NAV loans are rarely made longer than 5 years, usually 2-3 years, the multiple will rarely be very high

ΔMOIC = 10% × 0.4 = 0.04x

This is in a scenario where no benefit is provided from the loan. The bear case is a loss of 0.04x MOIC. Take the case where the NAV loan is used to avoid a premature exit due to liquidity concerns:

Exit today: 1.2 MOIC

Exit in 1 year: Price increases to 1.8 MOIC since the sale isn't being made under duress.

Taking the same cost as before (10% LTV NAV, 1.4x repayment multiple): ΔMOIC = 0.04x

Difference = (1.8 - 0.04) - 1.2 = 0.56x

The result is 14x upside potential vs downside. Talk about asymmetric returns.

The NAV loan is better in this scenario for two main reasons. The first, raising equity takes time. LPs want assurance that their investment is offering risk-adjusted returns. This can cause the fund to miss the deal entirely. As mentioned earlier, saturated markets require execution at every step to ensure the fund remains competitive. The second reason stems from the cost of capital. As the fund is seeking equity to finance a deal, LPs will recognize the time-sensitive nature of the equity raise as a form of duress, which they will leverage to negotiate fee waivers and other preferential terms. Not only are the terms going to favour the investor, but the fund will also miss out on equity returns. Negotiating a NAV loan, while it comes with interest expense, offers equity returns in a time-bound manner.

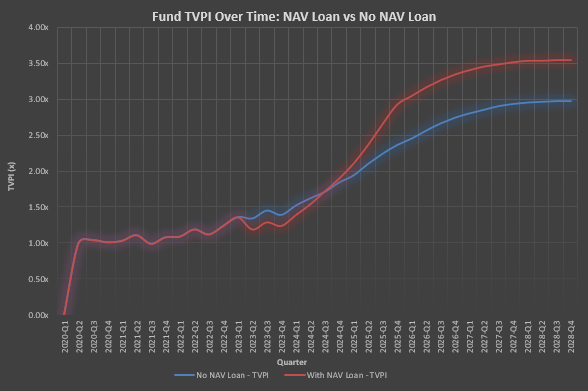

This strategy can be taken further. If a fund can source deals ahead of exits consistently, then leverage NAV loans to begin new deals ahead of exits, they can increase returns dramatically. The following graph reflects a model where a firm utilizes NAV loans 1 year before exit to push their timeline ahead, versus a fund that follows regular timelines.

*The model can be provided upon request to [email protected]

The NAV loan strategy uses the principles of the time-value of money and leverage to push more deals and more capital, working in unison towards outsized returns. Though it is important to note that the deals must be done under a clear operational strategy. The fund must have strong deals lined up or a clear direction to deploy the capital. Using the loan to artificially boost return metrics can introduce risk without value creation. This method can cause detriment to risk-adjusted returns and spook investors long-term.

All in all, NAV loans are a useful tool. They offer time optionality to PE funds in a time where execution in a time-sensitive manner is of utmost importance. As adoption increases (Investec's 2025 survey indicated that 80% of GPs used NAV financing in the last year), it will be important to monitor how the loans are being used, but I believe that they can create value for investors beyond what traditional PE strategies have been able to produce.

I'd like to thank Max Weichel of Felicitas GP for introducing me to the topic. His insights and support for this article were essential to its realization. For more information about NAV loans, I strongly recommend you read his article here.